Thai banking sector profits have seen a modest uptick for the first nine months of 2024, buoyed by rising interest and fee incomes. Yet, the backdrop of swirling economic uncertainties has kept banks on their toes, continuing to stash away hefty reserves for potential loan losses.

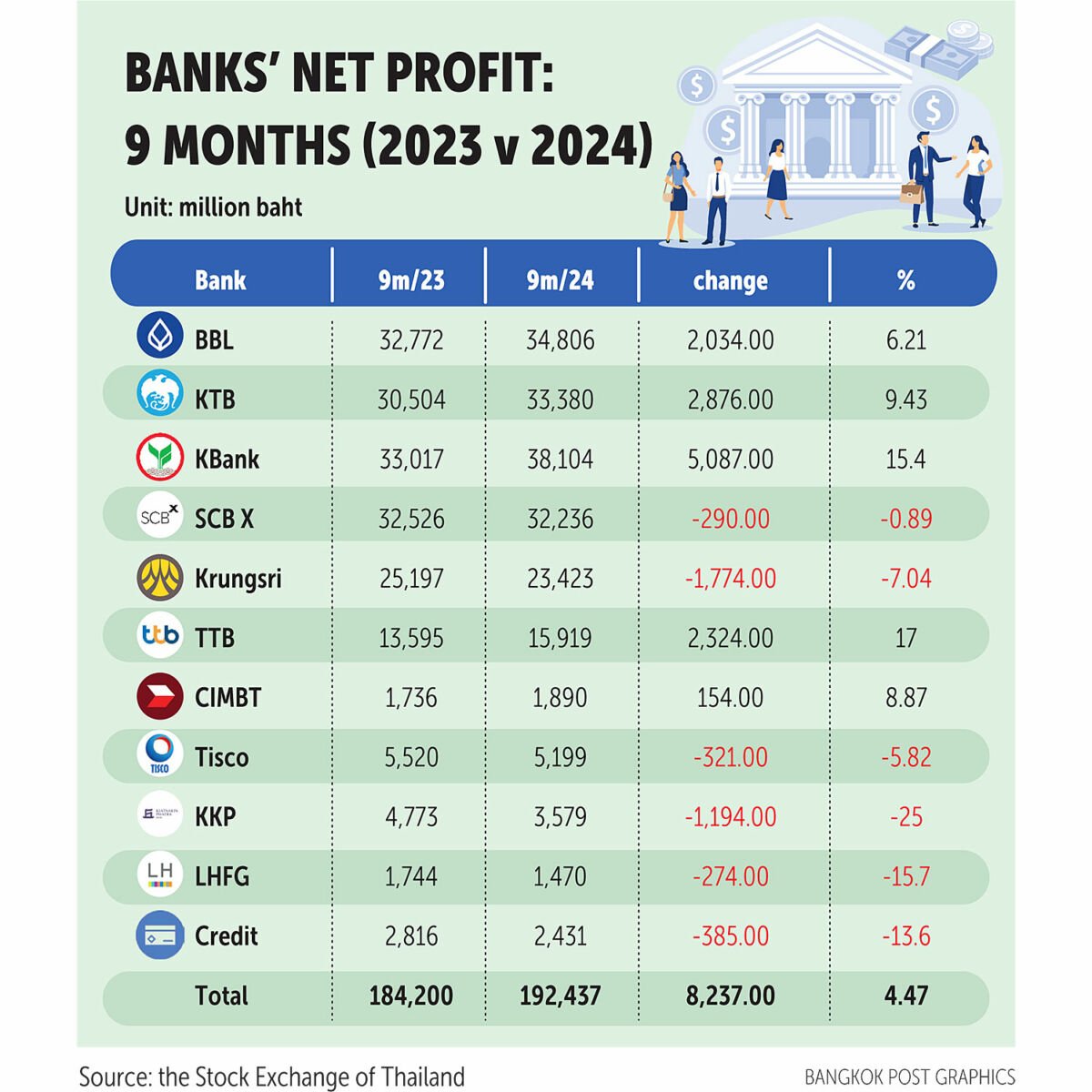

The pack of 10 Stock Exchange of Thailand (SET) listed banks and their subsidiaries reported a collective net profit of 159 billion baht, reflecting a 3.49% increase year-on-year. Notably, Krungthai Bank’s (KTB) figures remain under wraps.

Leading the charge, Kasikornbank (KBank) posted a net profit of 38.1 billion baht, up 15.4% from the previous year, while TMBThanachart Bank (TTB) claimed the crown for the highest profit growth, leaping up by 17% to hit 15.9 billion baht.

However, it wasn’t smooth sailing for all. Six banks watched their profits shrink, with Kiatnakin Phatra Financial Group (KKP) taking the hardest hit, experiencing a 25% slump.

KBank, the third-largest player in Thailand by total assets, credited its success to a surge in interest and fee-based incomes alongside support measures for its clients, said Kattiya Indaravijaya, KBank’s Chief Executive, in a SET report.

“We’ve launched several initiatives, like lowering loan interest rates to aid vulnerable customers hit by widespread floods. Our aim is to lighten their financial load and speed up their recovery,”

As the year rolls on, economic growth is anticipated, but lurking challenges such as flooding, baht fluctuations, global economy slowdowns, geopolitical jitters, and lagging domestic spending recovery cast a shadow over Thailand’s outlook.

Adding to the mix, SCB X, the holding company of Siam Commercial Bank (SCB), logged a net profit of 32.2 billion baht, marking a slight 0.9% dip from the previous year. Chief executive Arthid Nanthawithaya pointed to a one-off loss from selling subsidiary Purple Ventures and dwindling investment and fee incomes.

“We’re keeping a close watch on government policy impacts and macroeconomic shifts. The floods pose short-term risks, and the effects of cash handout schemes are yet to unfold.”

Meanwhile, the Bank of Ayudhya (Krungsri) reported a net profit shrinkage to 23.4 billion baht, down 7% year-on-year, hit hard by rising credit loss provisions. By September 30, outstanding loans stood at 1.92 trillion baht, down by 4.5% from December 2023—mirroring a cautious approach amid wavering business and consumer confidence.

Frequently Asked Questions

Here are some common questions asked about this news.

Why did Kasikornbank achieve the highest net profit in the sector?

KBank’s success stems from increased interest and fee-based income and targeted financial support initiatives.

How did TMBThanachart Bank achieve the highest profit growth among the banks?

TTB’s strategic initiatives and effective management practices contributed to its impressive 17% profit growth.

What if the economic challenges facing Thailand worsen in the coming months?

Banks may need to further increase reserves for loan losses, potentially impacting their profitability.

Why did Kiatnakin Phatra Financial Group experience the sharpest decline in net profit?

The decline was due to increased loan loss provisions and lower income from investments and fees.

How might government policies and macroeconomic developments influence SCB’s future performance?

SCB’s performance will be affected by how effectively they can navigate policy impacts and economic fluctuations.

The story Banking on gains: Thai banks ‘interest’ed in profit uptick for 2024 as seen on Thaiger News.